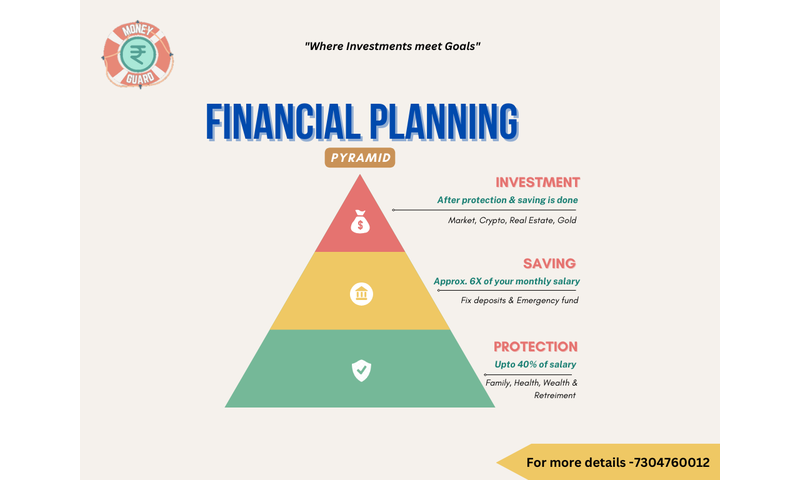

Financial Planning

”FIRST INVEST AND THEN SPEND”

What is financial planning ?

It means accessing your finances periodically with strategic asset allocation.

What is retirement planning?

Retirement planning means preparing today for your future life to continue to meet all your dreams and goals independently, including the main factor known as “passive income” or “pension”.

What is a pension ?

Amount of money that one receives in a bank account every month irrespective of Geopolitical issues or market crashes.

What are the factors one should consider when planning for a pension scheme? –

- It should be guaranteed

- It should be tax-free

- It should be government-approved

- It should be non-market lin

ked

Why as a Seafarer it is important to plan our financials for retirement?

INTRO-

Being a seafarer since 2012 I learned that, working on ships is not meant for everyone out there as the risk appetite is high including social disconnections. Nowadays at least we are having internet which keeps us in touch with our loved ones as well as the world around us. But still, I saw that because of being socially disconnected for a certain period of time we fall behind or miss out on updates and changes in the finance sector as compared to others working on land.

REALITY CHECK-

In the name of a savings scheme for a Seafarer's retirement, a provident fund (with decreasing interest rates) is cut every month from the wages if he/she is crew-provided and not working on Japanese flagships. When it comes to officers there is not a single provision to support their financial structure which will at least help to contribute some corpus when they retire. When it comes to our own personal investments we blindly believe in our friends, family, and also uncertified Finfluencers for any investment suggestions. They also at some point got from someone without any authentication about the source. Finally, we put our hard-earned money in such a place where there is no guarantee given even for the principal invested.

ALWAYS REMEMBER – “AT ANY GIVEN POINT RETURN OF YOUR MONEY IS MORE IMPORTANT THAN RETURNS ON YOUR MONEY”

ACTION-

So, to overcome such kind of problem it’s better to check for yourself first or take advice from a certified financial advisor who can guide you throughout.

The rule for investment-

- Why you are investing ? influenced by others, retirement, kid’s higher studies & marriage , other goals

- Where you are investing?

Once your goal is clear then you should think about the taxation on the investments. As seafarers, we do not pay taxes on our wages but there are many investments that you might be having which are taxable.

To know more about NRE/NRO saving bank account usage and restrictions for investments in India please click the link below:

ON SHIPS “SAFETY FIRST” THEN WHY NOT IN YOUR FINANCIAL PLANNING

So how MoneyGuard help a seafarer in planning his/her finances?

- Knows why a seafarer wants to invest?

- How much does a seafarer want to invest?

- Considering the age factor – how much risk he/she can take?

- Breakdown into long-term/short-term

- The curated plan is presented to the seafarer.

Why MoneyGuard?

- Certified financial advisor

- Simple English explanations

- Maximize tax saving

- Invested capital protection guarantee

- Works for the most trusted firm in India

- Provides the best option in the market for your required goals

Money Guard

Money Guard: Where Investments Meet Goals

Money Guard is dedicated to spreading awareness among seafarers about the importance of financial planning. Our vision is to ensure that every seafarer can secure their family's future and enjoy a peaceful retirement. We address essential questions like why retirement planning is crucial, the benefits it brings, and how a seafarer should approach it. We emphasize consulting certified advisors to navigate investment opportunities tailored for NREs (Non-Resident External accounts). Additionally, we provide insights on earning tax-free returns, maximizing the benefits of a seafarer's tax-free income.

Leave a comment

View more

Give your career a boost with S&B professional services.

CV Prep/EvaluationMore Jobs

Ship management

Mumbai

Senior Accounts Manager

Ship management

Mumbai

Marine Recruitment Assista..

Ship management

Mumbai

General Manager

Interview Prep/Mentoring

Find your polestar with the host of experts available on our platform

Know more